Individual personal loan offers offered to customers who originated by means of a paid Google or Bing ad element amount offers on LendingTree of no increased than 35.99% APR with terms from 61 days to 180 months. Your true level relies upon on credit rating score, financial loan volume, bank loan phrase, and credit rating usage and record, and may be agreed upon between you plus the lender.

SuperMoney gives comparison purchasing several bankruptcy possibilities, like consolidation financial loans. They offer funding by way of just about a dozen partners, and you will see comprehensive info and reviews about each one prior to filling out your application.

After filing for bankruptcy, your very best bet is to wait to rebuild your credit right before implementing for your vehicle financial loan. However, if you have to purchase now, store close to to uncover an offer that matches your finances and desires, and after that concentrate on earning your regular monthly motor vehicle mortgage payments promptly to help Make your credit rating.

Bankruptcy is one credit card debt relief possibility among numerous. Prior to deciding to choose ways to progress, it’s critical to grasp the rapid consequences of trying to find bankruptcy security. After your filing is approved, the court prohibits creditors from getting assortment actions from you. This “automated stay” implies that you’ll be lawfully guarded versus harassing phone phone calls, wage garnishment, assistance cutoffs together with other creditor actions till the case is solved.

Discover the figures. By the point you’re at the car dealership, you should know not just what kind of car you need but more importantly, what great site sort of deposit and regular payment it is possible to manage.

For now, in the event you experienced a repossession or surrendered your automobile and need a substitute before you can Construct up a far better credit ranking, inquire your self this:

How can persons get in such economic distress which they look at bankruptcy? Probably not amazingly, Lots of individuals find on their own in a nasty personal debt scenario resulting from unforeseen health care costs.

Getting a co-signer description on a car personal loan after bankruptcy could help it become much easier to qualify and probably make it easier to have a lower interest rate.

By applying with EasyAutoLenders.com , you conform to have your credit history pulled for lending purposes and This may have an impact to your credit score score. Thanks for your company!

Built to assist end users make confident decisions on-line, this this Web-site consists of information about a wide range of services and products. home Sure information, which include although not limited to charges and Distinctive features, are provided to us directly from our partners and they are dynamic and issue to change at any time without having prior see.

CGHS update: Central govt staff members need to mandatorily apply for new CGHS card on the web, how to apply, procedures, this content paperwork needed

A group of lawyers is standing by around the clock so you can quit any lawful problem rapidly and correctly.

org is different than other providers during the Area. Credit.org presents a wholly absolutely free own fiscal assessment along having an action plan that empowers you to make smarter decisions about your choices to stay away from bankruptcy. In addition, they can help you with your personal debt by means of personalised strategies.

uscourts.gov with the topic line: Professional Hac Vice Admission. Should you fail to well timed comply, you can keep your privilege to look and exercise, but you might drop your CM/ECF filing privileges until eventually you comply.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Robbie Rist Then & Now!

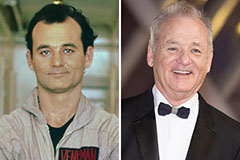

Robbie Rist Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!